child tax credit 2022 income limit

Thats because the child tax credit is dropping to 2000 for the year. A 2000 credit per dependent under age 17.

White House Unveils Updated Child Tax Credit Portal For Eligible Families

For your 2020 taxes which you file in early 2021 you can claim the full CTC if your income is 200000 or less 400000 for married couples filing jointly.

. Plus the stimulus of 1400. The child tax credit has been increased from 2000 to 3000 or 36000 depending on the age of the qualifying child. The income limit is 75000 if youre filing single and under 150000 if youre married filing jointly.

IRS Tax Tip 2022-33 March 2 2022. Ago CPA - US. What is the income limit for Child Tax Credit 2020.

The CTC is worth up to 2000 per qualifying child but you must fall within certain income limits. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. According to the IRS website working families will be eligible for the whole child tax credit if.

TikTok video from Virtual Tax Pro virtualtaxpro. If your income is below 15000 you will qualify for the full 35. 2022 Tax Brackets.

In 2017 this amount was increased to 2000 per child under 17. The maximum Earned Income. When you go through the process of filling out your 2021 tax return you will be able to claim the full credit for your newborn dependent.

Are you using any particular tax software program. Families with a single parent also called Head of Household with income of 112500 or less. Congressional Republicans temporarily raised those thresholds to 200000 for single parents and 400000 for married parents as well as doubled the credits maximum size to 2000 and made more.

3600 for children ages 5 and under at the end of 2021. The Kiddie Tax thresholds are increased to 1150 and 2300. The 500 nonrefundable Credit for Other Dependents amount has not changed.

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. 3for the 2021 tax year the child tax credit offers. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

Changes to the Child Tax Credit for 2022 include lower income limits than the original credit. Tax Changes and Key Amounts for the 2022 Tax Year. The maximum credit for taxpayers with no.

You must have claimed at least one child as a. Families who do not qualify under these new income limits are. The boosted full credit was 3600 per child up to age 6.

This credit does have a phase-out amount when you reach 400000 of adjusted gross income if you file married filing jointly or 200000. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less generous. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to. The refundable portion of the Child Tax Credit CTC was increased to 3600 for each qualifying child under 6.

2022 Child Tax Rebate 250 per child Maximum of 750 up to three children You must be a resident of Connecticut. Ct taxrebate childtaxcredit childtaxcredit2021 ctmoms conneticut conneticutmomstaxes statetaxes rebate. The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17.

What are the Maximum Income Limits for the Child Tax Credit 2022. 3000 for children ages 6 through 17 at the end of 2021. Jan 1 2022.

The refundable portion of the Child Tax Credit has increased to 1500. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. For children under 6 the CTC is 3600 with 300 optional monthly advanced payments.

The first one applies to the extra credit amount added to. Everyone else with income of 75000 or less. Married couples filing a joint return with income of 150000 or less.

Taxpayers with qualifying childrendependent between the ages of 6 and 18 get 3000. That said the age requirements also changed from 17 to 18. Parents in 2021 got a financial boost from the American Rescue Plan which expanded the child tax credit and gave families monthly checks.

You may use up to 3000 of. 2021 Earned Income Income Limits 2021 Child Tax Credit. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return.

Previously you were not able to get this credit for your child if they were 17. The income limit for this. For the tax year 2021 the child tax credit is increased from 2000 per qualifying child to.

They earn 150000 or less per year for a married couple. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. This tax credit is a percentage that is based on your adjusted gross income of the amount of work-related childcare expenses that you paid over the course of the year.

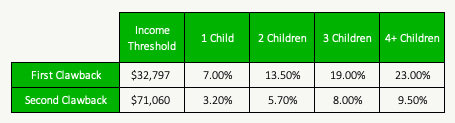

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Tying The Knot This Year Add Marriage Tax Penalty To Potential Cost

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Why Households Need 300 000 To Live A Middle Class Lifestyle

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit Will There Be Another Check In April 2022 Marca

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks